Corn, Bean & Cattle Options Strategies

January 22, 2026

Corn -

For upside strategies we have a couple of options. Keep in mind we want to keep our total expense in this market very minimal, but we do think we’re at the lower end of the range and at some value area. If you are someone who has corn in the bins paying storage, it might be worth it to take a look at selling some cash and re-owing those cash sales with options.

March corn $4.25 calls for appx 5 cents. This keeps things simple and gives you coverage through 2/20/2026, while being at the money

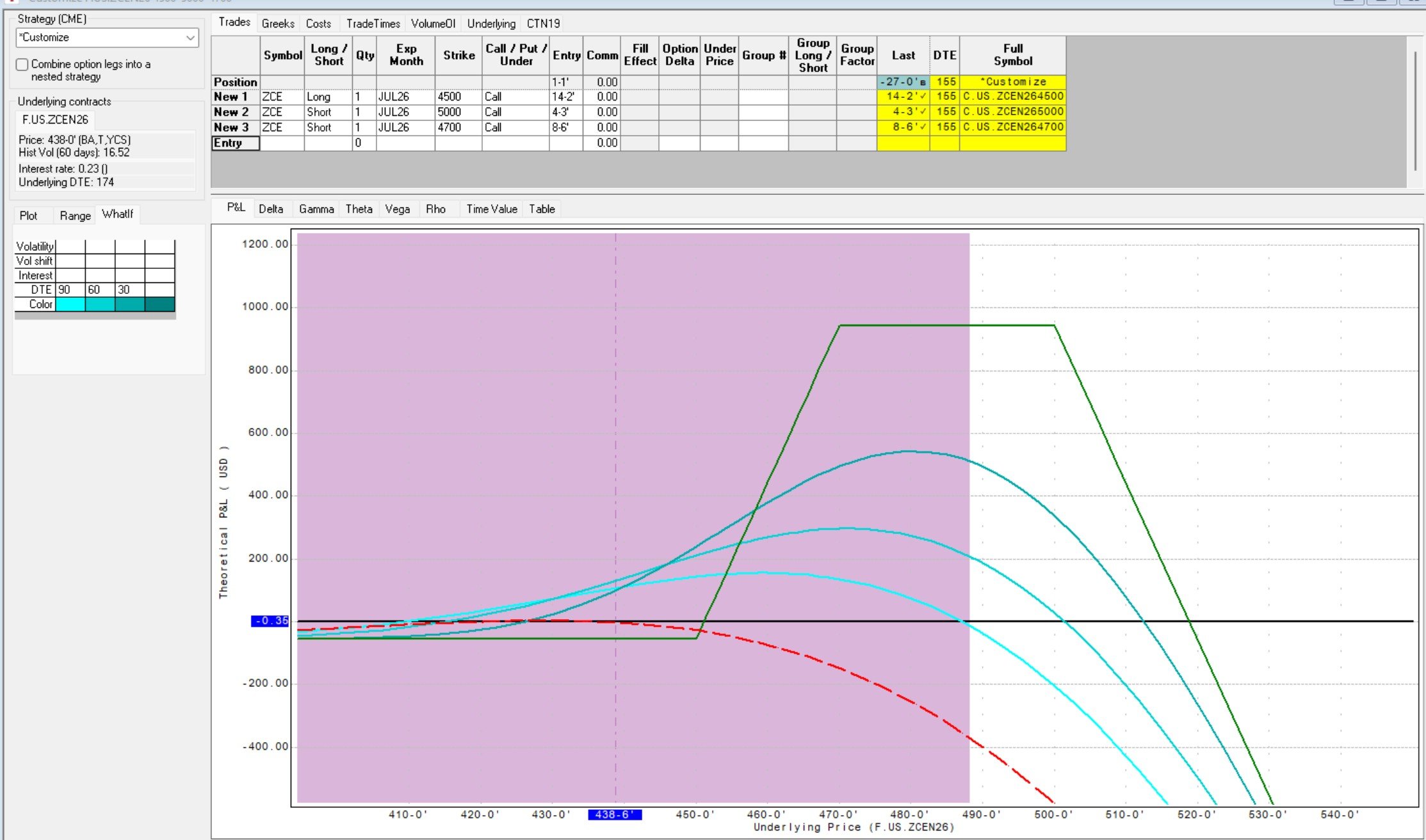

July corn Call Ladder - buy 1 July 450 call, sell one 470 call, sell one 500 call - net cost about one cent

For this strategy you are long 1 call and short two, so there is a margin requirement associated with it. However, the net cost is about a penny and it allows us to max out our trade between $4.70 and $5.00 and immediately start making money above $4.50. With this type of strategy it performs the best the closer you get to expiration. It has risk of losing money above $5.20. If you are interested give us a call to look at it more in detail. If we grind higher slowly, this trade will work well.

July Corn Call Ladder - Green line is profitablility

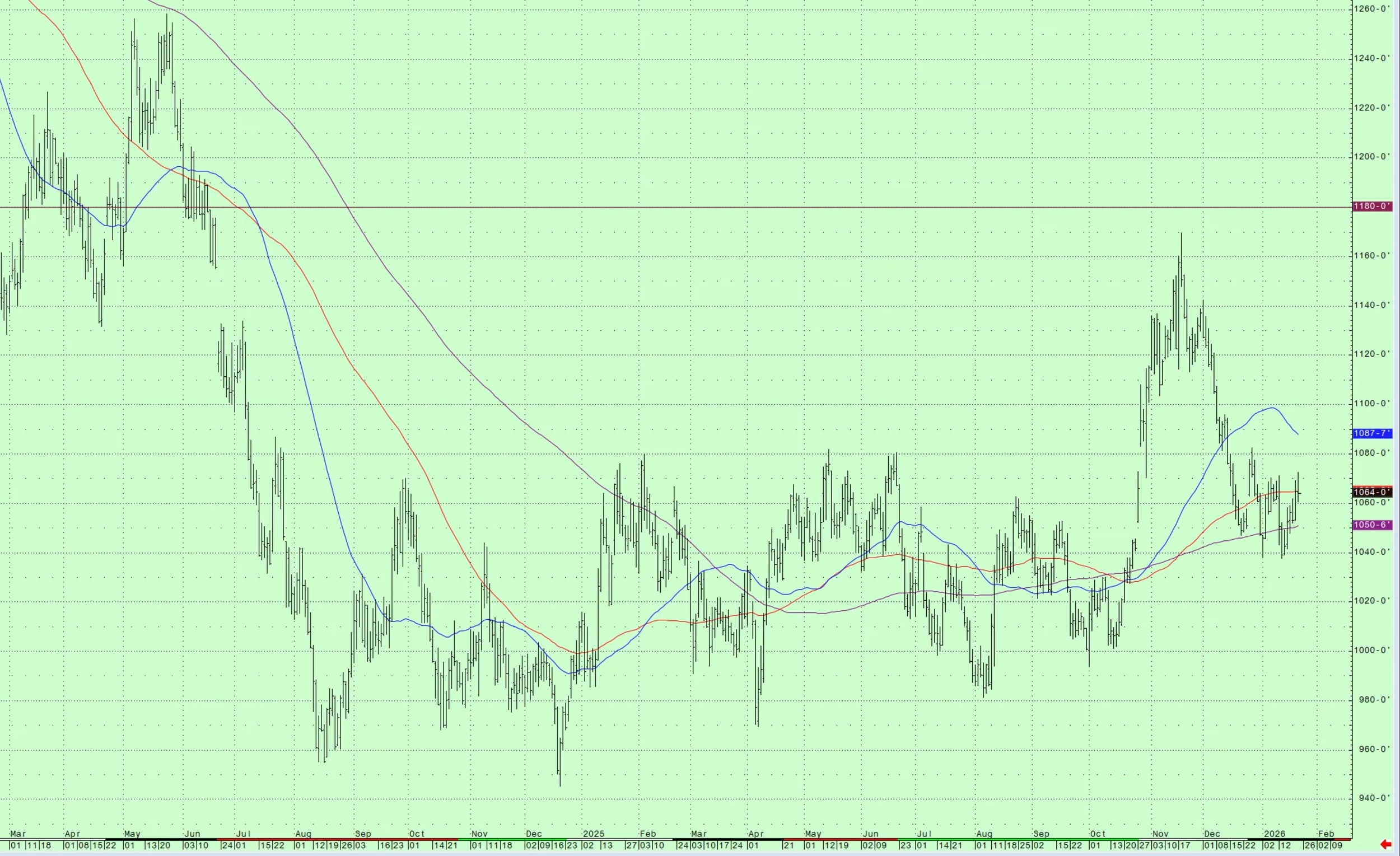

Soybeans -

We like owning long deltas for beans into planting. China has met their commitments and demand is fairly strong. Based off the balance sheets we think beans might have a stronger bias higher to buy acres during planting. We are looking at buying the April short dated $11.00 call (based off the Nov contract) and selling the April (regular) $11.80 call for about 5 cents. This gives our upside coverage in the new crop contract but both options expire at the same time.

Soybean continuous contract

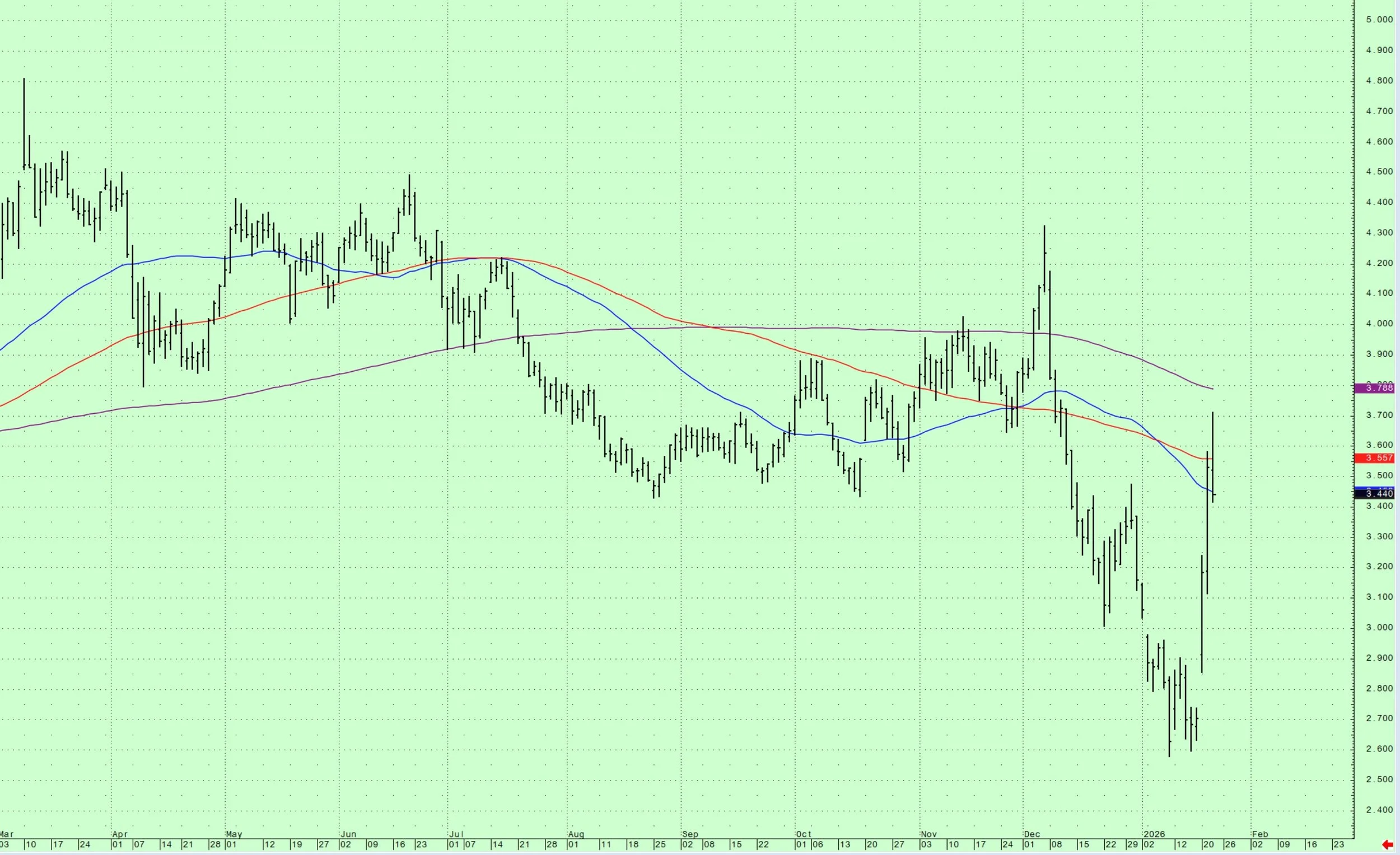

Feeders -

We think cattle are rangebound for now, and are at the upper end of the range. We like buying put spreads in the month you need the protection, if you want to avoid margin calls. We like puts better than LRP right now because of the strong basis. However, we also like coming in with straight futures as we do think we’re at the top end of the trading range. For example, we like buying the March 26 $3.50-$3.25 put spread for about $4.50. What this does is give you a window of $25 of downside protection for $4.50 of cost. In the chart below you’ll see the window of protection we like and we do think there is a very real chance we trade both sides of this range.

March 2026 Feeder Cattle

Natural Gas -

Natural gas hit our target, and of course the winter storm was pure luck. We now want to trade this market from the short side… with caution. Trade it, don’t marry it!