Downside Strategies for Corn

July Corn - Old Crop Protection

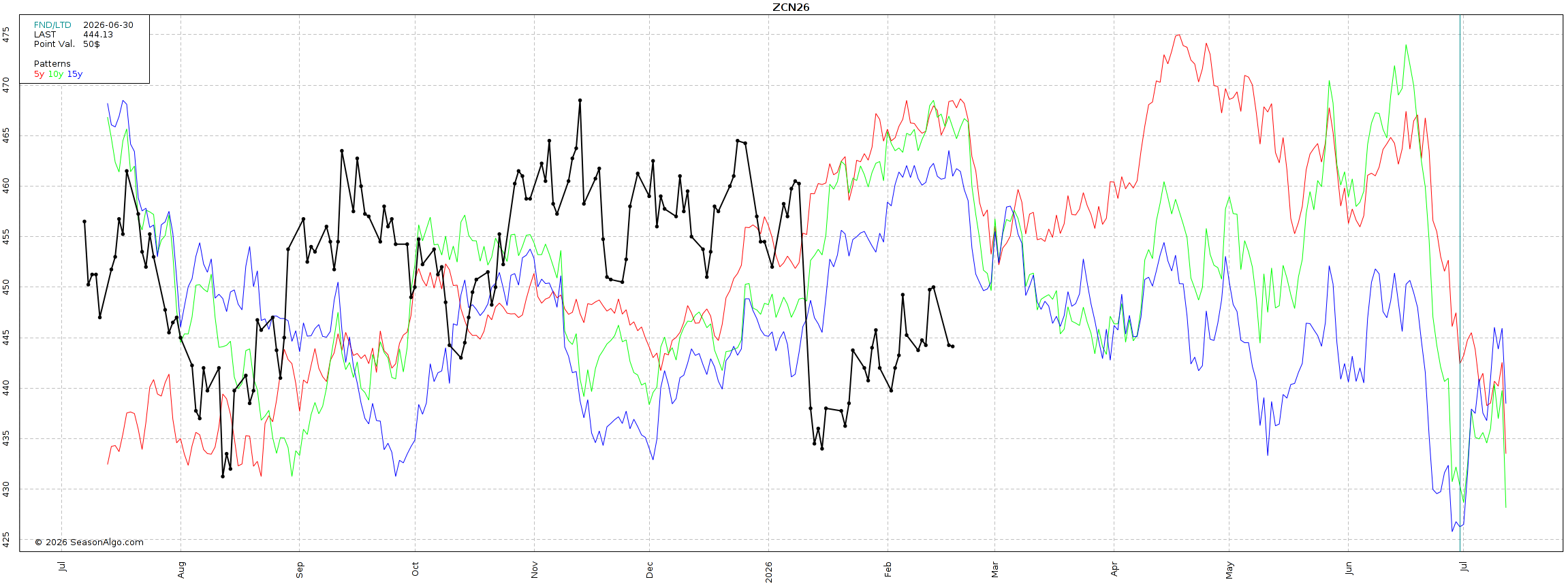

We are looking at BUYING the June $4.40 put and SELLING the $5.00 call for a net cost of approximately 8 cents. This would give us a floor at $4.40 and a ceiling at $5.00. The 2025 high for the July 2026 contract was $4.9875. The margin on this position is approximately $575/contract. The range of these options are highlighted below with the horizontal lines in the daily chart below. The second chart is the seasonal pattern for July corn, with the 5-year (red), 10-year (green) and 15-year (blue) historical patterns. We typically see some weakness through the end of March, coinciding with the insurance period being complete.

July 2026 Corn Chart

Seasonal Pattern for July Corn

New Crop - December 2026 Corn

For December 2026 corn we are looking at some OTC trades. OTC stands for Over The Counter and essentially is an options strategy that is bundled together for you through an OTC provider. These are through a separate account that we offer, but allows you the flexibility to own the position rather than doing the OTC position traditionally with the elevator. The OTC provider we work with also offers margin financing on hedge positions if you are margin sensitive.

December 2026 Corn Barrier Strip Put

How it works:

Dec corn @ 4.60 for reference

Every day the market is above $4.50 - nothing happens.

Every day the market is below $4.50 - you get paid the difference between $4.50 and $4.20.

If the market trades below $4.20 - the structure knocks out and no further pricing occurs.

Cost - 3.75 cents

*These pricings are indicative only.*

For a low cost, we think this is a great way to accumulate some premium in a sideways market.

December Corn Chart

Disclaimer: Trading futures, options on futures, and retail off-exchange foreign currency transactions are complex and involve substantial risk of loss and are not suitable for all investors. There are no guarantees of profit. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Options, market data, and recommendations are subject to change without notice. Texas Hedge Risk Management and/or TXRM, LLC shall not be held responsible for any actions taken based on this communication. Parties acting on this communication are responsible for their own actions. Past performance is not necessarily indicative of future results. The information in this site is to be used for information only and is not a solicitation or guarantee of performance.