Pre Report Positioning - the one we’ve been waiting for

This market has been sleepily waiting for updated balance sheets with the January 12, 2026 WASDE report. Fund rebalancing is occurring now and we are seeing new capital flows for the new year. Corn carryout is estimated at just under 2 billion bushels with an estimated 184 corn yield. This report has historically created some big market movement.

Here are a few scenarios we like:

If you want upside exposure in corn:

Ratio trades:

Buying 2 March 4.50 calls - selling 1 Dec 26 5.00 calls for approximately no cost

Buying 3 Feb 4.50 calls - selling 1 Dec 26 5.00 calls for a slight credit

Or keeping it simple: - buy Feb 4.55 calls for less than 5 cents

Feb calls expire 1/23/26 and March calls expire 2/20/2026

If you want downside coverage in corn:

April short dated 4.55 puts for 5 cents or less - gives you protection against the December contract, expiring 3/27/26. Gives you a net floor of $4.50 with your upside open through the first quarter of the year.

If you want upside exposure in beans:

Buying Feb 11.00 calls for around 3 cents or less

Buying March 11.10 calls for 7 cents or less

No margin requirement and gives you participation in Monday’s report for a fixed cost. Unlimited upside.

If you want downside coverage in beans:

March short dated 10.60 puts for 10 cents or less - gives you protection against the November contract, expiring 2/20/2026. Leaves your upside open and buys you a floor, with the ability to make further decisions after the China bean purchase window expires

March 10.50 put for 15 cents or less - if we have a bearish report we would expect the front month contracts to sell off more than the deferred contracts allowing you to pick up some value on the spread

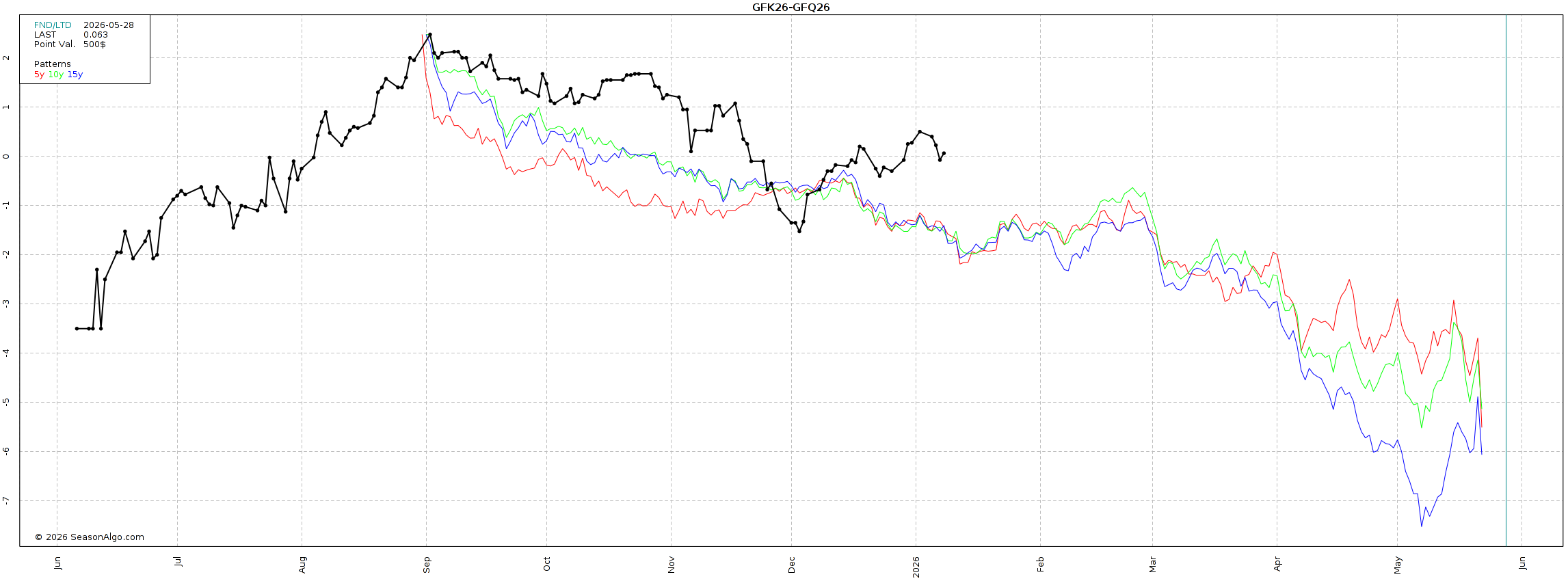

If you want to trade a feeder cattle spread:

Selling May Feeders - Buying Aug Feeders - typically August is premium to May and right now they are even. Margin on this spread is $800/contract.

5 year, 10 year and 15 year seasonal pattern of the May/Aug Feeder Cattle Spread

This is for informational purposes only. Past performance is not indicative of future results. These are our best intentions on positioning before the report but in no way is a guarantee of performance. You should carefully consider if these strategies are a good fit for you because there is risk of loss in futures and options trading.